s corp tax calculator excel

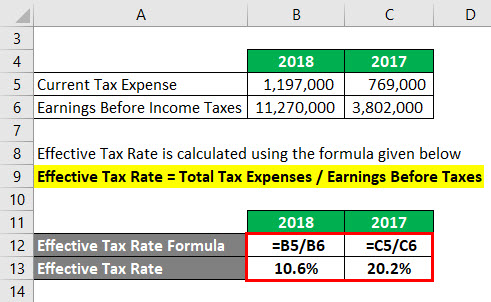

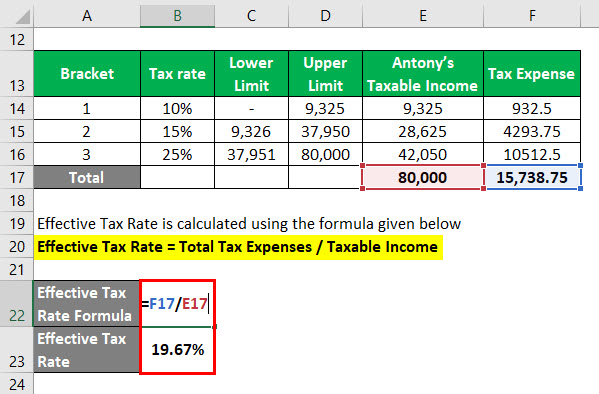

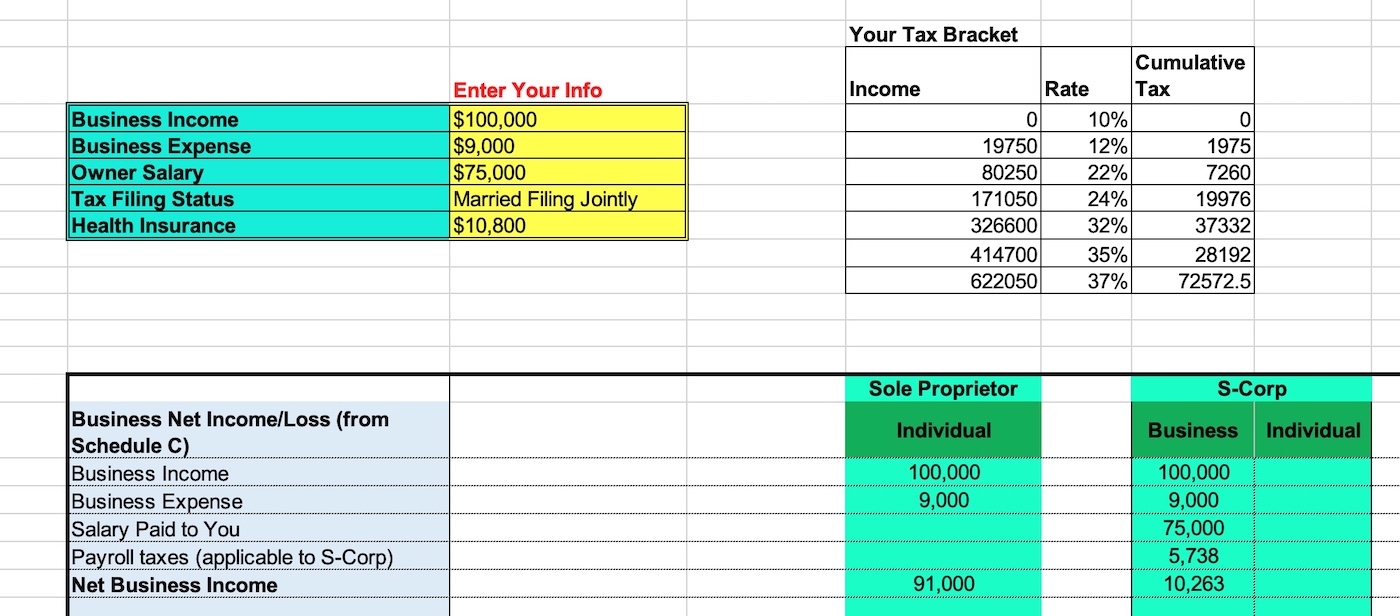

Examples of Effective Tax Rate Formula With Excel Template Lets take an example to understand the calculation of Effective Tax Rate in a better manner. Being Taxed as an S-Corp Versus LLC.

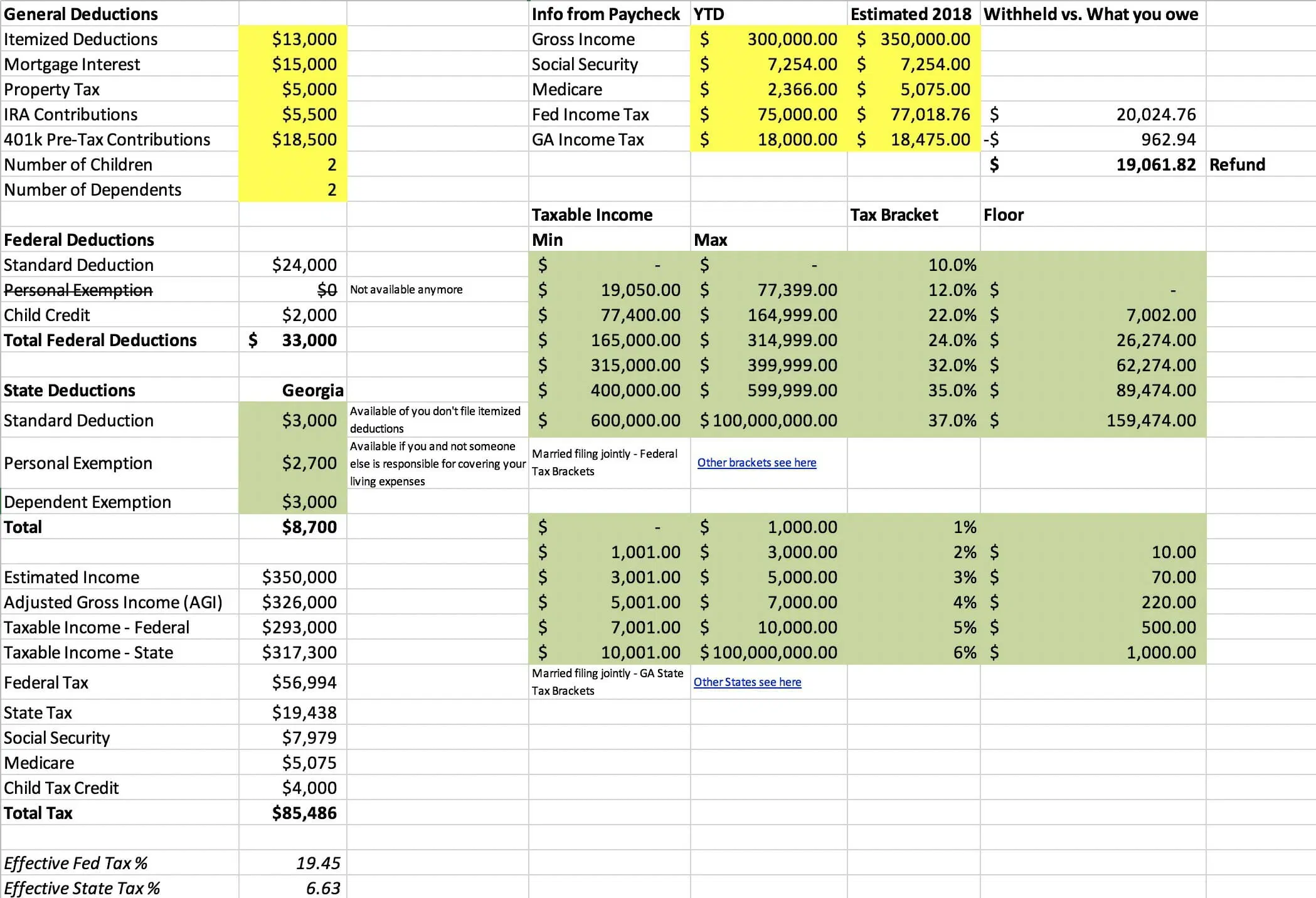

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

For filing an s corp only.

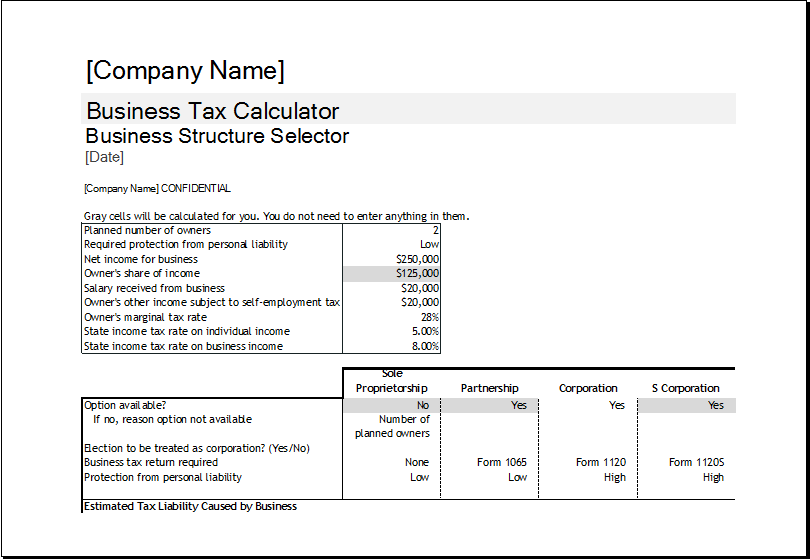

. The S-corporation Tax Savings Calculator allows you to compare SOLE-PROPRIETOR VS. This tax calculator shows these values at the top of. Were always interested in hearing about any useful resources which you may be using that other members may appreciate.

The entity compares tax rates across S C and limited liability corporations. Calculator for taxation LLCs vs. We are not the biggest firm but we will work with you hand-in-hand.

This allows owners to pay less in self-employment taxes and contribute pre-tax dollars to 401k and health insurance premiums. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience including work with or on behalf of companies like. These calculations are for illustrative purposes only in order to show you how two general scenarios differ.

If your business has net income of 70000 and youre taxed as an LLC you will owe nearly 10000 in self-employment tax. The SE tax rate for business owners is 153 tax of the first 142800 of income and 29 of everything over 142800. Works best with Microsoft Office Excel 2007 or later version incompatible with Microsoft Office Excel for Mac.

Now if 50 of those 75 in expenses was related to meals and. 1 Select an answer for each question below and we will calculate your S-corp tax savings. If you need help with LLC vs.

File irs form 2553 which elects your corporation to become an s corp. However if you elect to be taxed as an S-Corporation and take a 40000 salary with the remaining 30000 being a distribution to you or you keep it in the business you pay only. Income tax calculator for non-resident individuals XLS 67KB.

Normally these taxes are withheld by your employer. YA 2021 XLS 130MB New. There is not a simple answer as to what entity is the best in terms of incorporation.

Bookkeeping Records If you use a bookkeeping system other than Xero you can provide us with a. Effective Tax Rate Formula Example 1. S corp tax calculations you can post your legal need on UpCounsels marketplace.

S corp tax calculator excel. Forming an S-corporation can help save taxes. Click here to download the mba excel tax liability estimator.

For simplicity this example does not include the 20 deduction for Qualified Business Income that became available to owners of pass-through businesses under the Tax. How S Corporations Help Save Money. The corporation tax calculator is useful for calculating.

In many countries an individuals income is divided into tax brackets and each bracket is taxed at a different rate. However as an S corporation grows or scales back the basis calculation can change as the investment of the shareholder shifts. Tax Calculators and other useful tools AccountingWEB offers a range of tax calculators as well as other tools and resources on its products pages.

As Jaynes tax adviser you should provide a dynamic tax analysis being mindful of how each federal tax levy will change if Jaynes business grows in the future. Completing a tax organizer will help you avoid overlooking important. The corporation tax calculator allows companies in the UK and companies based outside the UK with offices or branches in the UK to calculate their corporation tax based on their companies financial year or using a standard tax year the 2022 tax year for example runs from the 1 st April 2022 to the 31 st March 2023.

From the authors of Limited Liability Companies for Dummies. Here is a calculator which allows you to calculate what your effective tax rate would be for each type of business entity. This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance.

Just complete the fields below with your best estimates and then register to get your CPA or schedule a free Consultation here. Electing S corp status allows LLC owners to be taxed as employees of the business. Therefore use the accompanying Excel template to complete a comprehensive federal tax analysis at four levels of business income 100000 200000 400000 and 600000.

YA 2020 XLS 1. Click here to go to the tax calculators and checklists page. Calculating Your S-Corp Tax Savings is as Easy as 1-2-3.

Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. UpCounsel accepts only the top 5 percent of lawyers to its site. Basic Corporate Tax Calculator BTC BTC for Companies Filing Form C-S.

S corp basis calculation refers to the amount the owner has invested in the business or property. LLCs taxed as S Corporations allow their owners to receive tax-advantaged income as distributions. When the investor first makes an investment in the business this is the initial cost of the property.

This calculator helps you estimate your potential savings. This offers you an estimate for your business net income for the year to use in our S Corp tax savings calculator. On this page you will find.

Get the spreadsheet template HERE. S Corp vs LLC Tax Savings Calculator. Your corporation may legally avoid double taxation on the business and its shareholders due to the pass-through election associated with an S Corp.

Our calculator will estimate whether electing S corp will result in a tax win for your business. Unlike a C Corporation an S Corp still enjoys the pass-through tax filing that partnerships pay. Prior Years Tax Returns If you are a firsttime tax client please provide a copy of the corporations tax returns for the past 3 years Federal and State.

For example if you have a business that earns 200 in revenue and has 75 in expenses then your taxable income is 125. Heres how your taxes stack up as a sole prop vs. Youll also be filing form W-2 to pay an employee salary effectively becoming an employer paying payroll or employment tax.

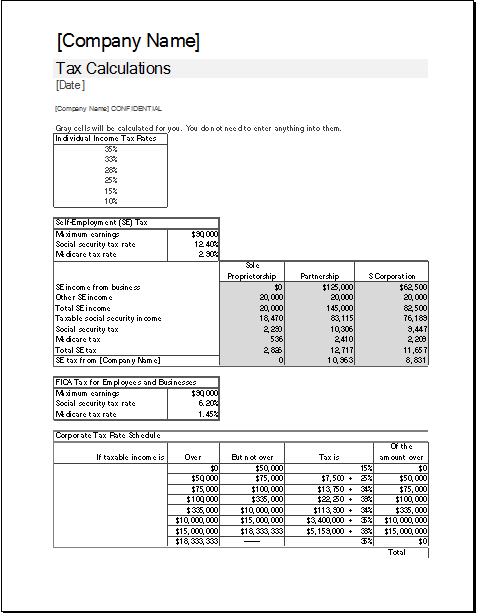

Corporate Tax Calculator Template For Excel Excel Templates

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

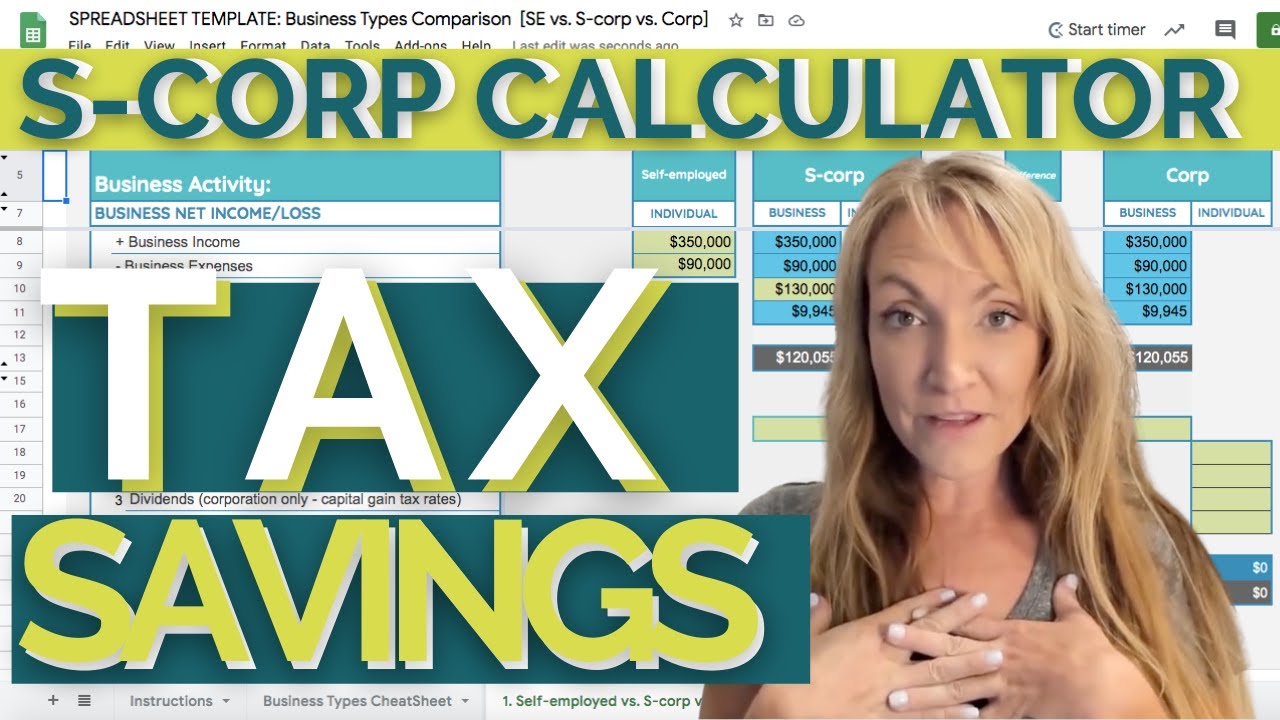

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

Corporate Tax Calculator Template For Excel Excel Templates

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

The Basics Of S Corporation Stock Basis

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Excel Formula Help Nested If Statements For Calculating Employee Income Tax

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Sole Proprietorship Vs S Corp Tax Spreadsheet For Internet Publisher And Youtuber Which Will Save More Tax Money Techwalls

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download